The rising cost of living has been a massive headache for families across the UK, right? It feels like everyone’s constantly searching for any bit of government help they can get. And lately, there’s been a lot of chatter and whispers about a new £600 Cost of Living Payment supposedly coming in 2025. It’s caused a mix of hope and, let’s be honest, a fair bit of confusion.

So, we’re here to cut through all that noise. This article is all about giving you the straight facts, a comprehensive, no-nonsense breakdown of what UK cost of living support really looks like right now, and to set the record straight on any such payment for 2025.

Knowing what genuine help is out there is absolutely critical for smart financial planning. While the thought of a big, one-off payment certainly sounds appealing, it’s super important to stick to official information. We need to understand the actual provisions the government has in place to lend a hand to those who are finding things tough. This detailed guide will walk you through what support is genuinely on offer and how you can access it, moving past all the speculation to give you practical, actionable insights.

The Truth About the £600 Cost of Living Payment in 2025: Is It Happening?

That news circulating about a £600 Cost of Living Payment in 2025 has, understandably, caught a lot of attention among UK households. Many of us are still grappling with ongoing financial pressures and are eager for any extra assistance. But it’s crucial to tackle these claims with accurate information, straight from official sources, because misinformation can lead to all sorts of false hopes and frustration.

Here’s the thing: the idea of a new, widely distributed £600 Cost of Living Payment in 2025 just isn’t backed up by official government announcements. While you might have seen some reports online or discussions on social media hinting at such a payment, these claims are purely speculative. They don’t reflect current government policy. So, please, households should be really cautious when they come across unverified information like this. Always, always check official government channels for clarity on financial support.

Dispelling the Rumours: What Official Sources Say About a £600 Payment

The Department for Work and Pensions (DWP) has actually confirmed pretty clearly that there won’t be any further broad Cost of Living Payments in 2025. That temporary scheme, which dished out a series of payments between 2022 and 2024, has now wrapped up. The final payment, according to both Gulf News and GOV.UK, was made between February 6 and February 22, 2024. That directly contradicts any whispers you’ve heard about a new £600 payment coming our way next year.

Sure, some online places, like OperationDV, have mentioned a rumoured £600 payment for September 2025. But again, these remain totally unconfirmed by the DWP or any government department. It seems these reports are based on speculation, not official policy. It’s really important for anyone looking for UK cost of living support in 2025 to understand that the government has changed its approach. They’re now focusing on other established channels of support rather than rolling out new, huge one-off payments.

Understanding Previous Cost of Living Payments (2022-2024)

To really get why there isn’t a new £600 Cost of Living Payment in 2025, it helps to look back at how these payments worked before. Between 2022 and 2024, the UK government launched a series of Cost of Living Payments as a direct response to, you guessed it, the soaring cost of living crisis, as confirmed by GOV.UK. These payments, which varied from £150 to £326, were specifically designed to give targeted financial relief to certain groups of people.

These earlier payments were aimed at low-income households receiving specific benefits like Universal Credit, as well as pensioners and individuals with disabilities. The whole idea was to offer a temporary financial boost to those who were most vulnerable to rising prices. They were one-off, non-repayable sums, meant to help cover essential costs during a tough economic period. The DWP has confirmed that this temporary scheme is now over, which means those direct, large-scale payments aren’t continuing into 2025.

Why the Confusion? Examining the Sources of Misinformation

So, why do these rumours about a new £600 Cost of Living Payment in 2025 keep popping up? Well, it’s a mix of things, really. There’s the very natural human desire for financial relief, the incredibly fast way unverified information spreads online, and sometimes, a lack of super clear communication. The previous success and widespread impact of the 2022-2024 Cost of Living Payments probably contributes to people expecting similar schemes to continue.

Misinformation often spreads like wildfire across social media platforms, unofficial news websites, and even from simply misunderstanding legitimate financial advice. Without official confirmation, even sharing information with good intentions can lead to widespread confusion. If you’re looking for government cost of living help in the UK, it’s absolutely essential to cross-reference any information with reputable and official sources like GOV.UK. This ensures you’re getting accurate, up-to-date guidance and aren’t relying on claims that simply aren’t true.

What UK Government Support is Actually Available in 2025/2026?

Okay, so while a huge £600 Cost of Living Payment isn’t on the cards for 2025, the UK government is still providing various forms of assistance to help households deal with financial pressures. The strategy has simply shifted from those broad, one-off payments to more targeted, ongoing support mechanisms. Understanding these current provisions is key for anyone seeking financial help in the coming years.

For 2025 and 2026, the emphasis is on making existing support structures stronger, adjusting benefit rates, and providing localised aid through funds like the Household Support Fund UK. This really shows a strategic move towards embedding assistance within our existing welfare system and giving local authorities more power to tackle specific community needs. So, instead of waiting for a big payment, households should really focus their attention on these established avenues of support.

The Household Support Fund (HSF): Localised Assistance Explained

The Household Support Fund (HSF) is a really important piece of the UK’s cost of living support puzzle, and it’s running from April 1, 2025, to March 31, 2026. This fund allocates a hefty £742 million to local authorities in England, giving them the power to provide direct help to vulnerable households who are struggling with essential costs, as confirmed by GOV.UK. This localised approach is brilliant because it lets councils tailor support specifically to the unique needs of their own communities.

HSF support can come in all sorts of forms. We’re talking vouchers for food and fuel, emergency short-term financial aid, help with energy costs, and even, in special circumstances, providing or repairing essential household appliances. For example, councils like Rochdale have already shared plans to invest £4.1 million in things like food vouchers during school holidays, emergency fuel vouchers, and assistance with white goods, according to Rochdale Council. Just remember, eligibility and the application process are all handled by individual local councils. So, if you’re a resident, you absolutely need to check your local authority’s website for the specific details. Westmorland and Furness Council, for instance, mentioned that they typically only allow one application per household per funding period.

DWP Benefit Rate Increases: What to Expect in April 2025 and 2026

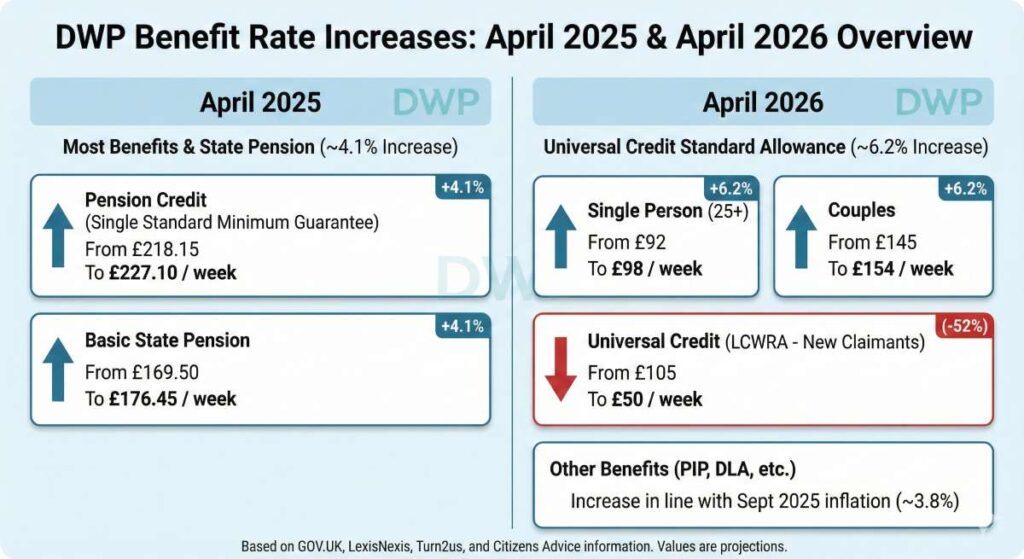

Good news on the benefits front! The Department for Work and Pensions (DWP) has announced some pretty significant benefit increases for 2025 and 2026, which are a major part of the government’s cost-of-living help for the UK. In April 2025, most benefits, including the State Pension, are set to go up by roughly 4.1%, according to GOV.UK. What does this mean for you? Well, a single person’s standard minimum guarantee for Pension Credit will climb from £218.15 to £227.10 per week, and the basic State Pension is projected to increase from £169.50 to £176.45 weekly, as reported by LexisNexis.

Looking a bit further ahead to April 2026, the Universal Credit standard allowance is expected to see a substantial increase of about 6.2%. This is a combination of a 3.8% inflation rate and a 2.3% standard allowance increase, according to Turn2us. This translates to a weekly allowance increase for a single person aged 25 or over, jumping from £92 to £98, and for couples, from £145 to £154. However, it’s worth noting an important detail: the health-related element of Universal Credit for new claimants receiving the Limited Capability for Work-Related Activity (LCWRA) element will be reduced by about half, from £105 to £50 per week, as stated by Citizens Advice. Other benefits, including Personal Independence Payment (PIP) and Disability Living Allowance (DLA), will generally rise in line with the September 2025 inflation rate of 3.8%, as per GOV.UK.

Changes to Universal Credit Deduction Caps: A Positive Development for Claimants

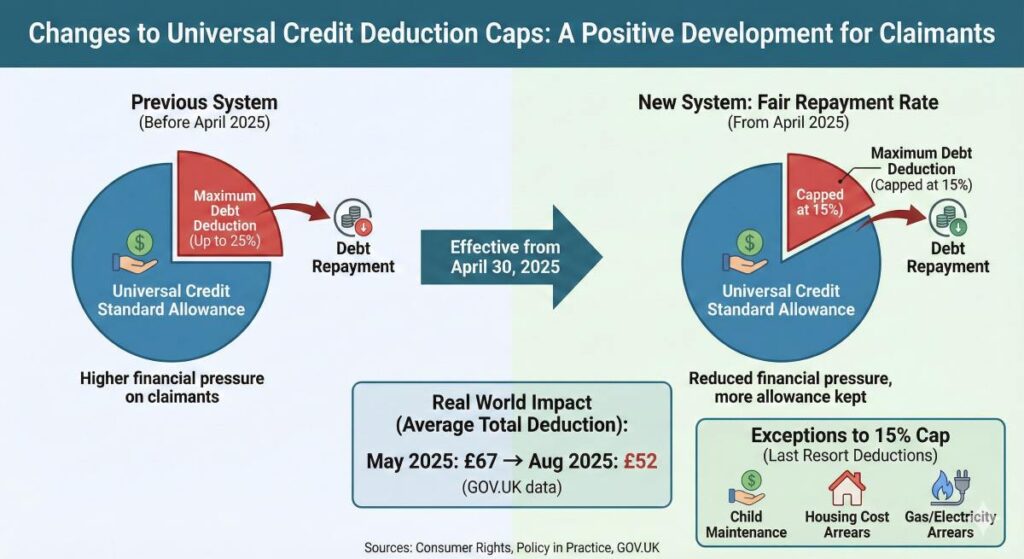

Here’s something truly positive for Universal Credit claimants: the UK has brought in some significant changes to deduction caps in 2025. The biggest and most impactful change is the introduction of the Fair Repayment Rate from April 2025. This has reduced the maximum deduction limit from 25% down to 15% of the Universal Credit standard allowance, according to Consumer Rights and Policy in Practice. This adjustment is specifically designed to ease the financial pressure on those who rely on Universal Credit.

The Fair Repayment Rate, which came into effect on April 30, 2025, puts a cap on the total amount of debt deductions that can be taken from a household’s Universal Credit payment. This applies to most types of debt. As a result, the average total deduction amount for Universal Credit households actually decreased from £67 in May 2025 to £52 in August 2025, as stated by GOV.UK. What this really means is that claimants get to keep a larger chunk of their monthly allowance, giving them more breathing room to manage essential expenses. Just a heads-up: exceptions to the 15% cap only apply to “last resort deductions” such as child maintenance, housing cost arrears, and gas/electricity arrears, as outlined by GOV.UK. This ensures crucial obligations are still met.

Who is Eligible for Current Cost of Living Support and How to Access It?

Navigating all the different forms of UK cost of living support can feel a bit like trying to solve a puzzle, but understanding the eligibility criteria and knowing the right places to apply is so important. With the shift away from those big, one-off payments, the focus is now on targeted assistance through existing schemes and local initiatives. Taking the initiative to find out what you’re entitled to and applying for it can genuinely make a huge difference in managing your household finances.

It’s really vital to remember that different support mechanisms have distinct requirements – what applies to one might not apply to another. So, having a clear understanding of each fund or benefit, plus knowing exactly where to find accurate information and apply, is absolutely paramount. This section will guide you through how to figure out your eligibility and get your hands on the help that’s available.

Navigating Eligibility for the Household Support Fund

Eligibility for the Household Support Fund UK is decided at the local council level, which means the criteria can change depending on exactly where you live. Generally, the fund is there to help vulnerable households and those facing financial hardship who are struggling to cover essential costs like food, energy, and water bills. Local councils will look at applications based on the specific needs and circumstances within their community, as highlighted by Birmingham City Council.

To figure out if you’re eligible, your best bet is to visit your local council’s website. These sites will usually have detailed information on who can apply, what kind of support is on offer, the application process, and any documents you might need (like proof of residency, financial circumstances, and identity). Councils often have specific application windows, so it’s a good idea to check regularly and submit your application quickly. For instance, BCP Council had application periods between September 2025 and January 2026.

Understanding Criteria for Universal Credit and Other Benefit Increases

The criteria for receiving those increased DWP benefit payments in 2025 and 2026 are generally linked to whether you’re already eligible for the specific benefits themselves. For example, if you’re already receiving Universal Credit, you’ll automatically see your standard allowance increase in April 2026, as per Citizens Advice. Likewise, pensioners who are already receiving the State Pension will benefit from the 4.1% increase in April 2025, as reported by LexisNexis.

For other benefits like Personal Independence Payment (PIP), Disability Living Allowance (DLA), Attendance Allowance, Carer’s Allowance, and Employment and Support Allowance (ESA), the increases will simply be applied to eligible recipients in line with inflation. If you’re a current claimant, it’s always a good idea to make sure your personal circumstances are up to date with the DWP. New claimants, of course, will need to meet the standard eligibility criteria for each respective benefit to receive the adjusted rates. For all the nitty-gritty details on benefit and pension rates for 2025-2026, GOV.UK is your go-to source.

Where to Find Official Information and Apply for Support (GOV.UK, Local Councils)

When you’re looking for government cost of living help in the UK, it is absolutely essential to stick to official and trustworthy sources. The main online resource for comprehensive and up-to-date information is GOV.UK. This government website provides detailed guidance on all national benefits, pensions, and support schemes, including the specific rates for 2025 and 2026. It’s truly the definitive place to understand changes to DWP benefit increases and eligibility criteria.

For localised support, especially anything to do with the Household Support Fund, your local council’s official website is the critical point of contact. Every council will publish information about its specific HSF allocation, eligibility requirements, and the application process, including forms or online portals. Seriously, never rely on unofficial websites or social media for critical information about financial support. Always, always verify details directly with GOV.UK or your local council to ensure you’re getting accurate information and avoiding any misinformation.

Beyond Payments: Broader Strategies for Managing Cost of Living in the UK

While direct payments and those much-needed benefit increases offer crucial relief, taking a comprehensive approach to managing the cost of living in the UK also means having some proactive personal strategies up your sleeve. Empowering ourselves with the knowledge and tools to manage our finances, cut down on spending, and tackle debt can seriously boost our financial resilience. This goes beyond just immediate government aid and looks at more sustainable, long-term solutions.

Navigating our current economic climate really calls for a multi-faceted approach. By combining an understanding of the government support that’s available with effective personal finance practices, individuals and families can do a much better job of softening the blow of rising costs. This section dives into practical strategies that complement government assistance, helping you build greater financial stability.

Budgeting Tips and Financial Planning Resources

Effective budgeting and financial planning are absolutely fundamental tools for navigating the UK’s challenging cost of living landscape. A well-structured budget allows you to track your income and expenditure, spot areas where you could potentially save, and prioritise your essential outgoings. Organizations like Citizens Advice or the MoneyHelper service offer free, impartial advice and tools that can help you create a realistic budget, according to their respective websites.

Beyond just basic budgeting, exploring broader financial planning resources can help you set long-term financial goals, like saving for emergencies or managing bigger expenses. Using budgeting apps, online calculators, and free financial workshops can really boost your financial literacy and empower you to make informed decisions. Proactive financial management, believe it or not, is a powerful form of UK cost of living support in itself, giving you greater control over your personal finances.

Energy Efficiency and Household Savings

Cutting down on household expenditure, particularly on utilities, is a vital strategy for managing the cost of living in the UK. Seriously, implementing energy efficiency measures can lead to some significant long-term savings. Simple steps like improving insulation, using energy-efficient appliances, switching off lights and electronics when you’re not using them, and smartly managing your thermostat settings can all collectively reduce your utility bills. Organisations like the Energy Saving Trust offer loads of practical advice and resources on how to make your home more energy efficient.

And it’s not just energy! You can find other household savings by carefully reviewing recurring expenses like subscriptions, insurance, and groceries. Comparing prices, taking advantage of loyalty programs, and planning your meals can contribute to substantial savings over time. Many local councils also offer specific schemes or advice on reducing energy costs, often linked to the Household Support Fund UK, so it’s definitely worth checking out your local resources.

Debt Advice and Support Services

For many households, managing the cost of living in the UK inevitably means dealing with existing debt or even new debt that’s piling up. When financial pressures start to feel overwhelming, seeking professional debt advice is a crucial step. Loads of charities and organisations offer free, confidential, and impartial debt advice, helping people understand their options and create sensible repayment plans.

Organisations like StepChange Debt Charity and National Debtline provide invaluable support, from helping you create debt management plans to advising on formal insolvency options if things get really tough. Early intervention is key here – addressing debt proactively can prevent it from spiralling out of control. These services offer a real lifeline for those who are struggling, making sure they can access expert guidance and find a pathway to financial recovery, all while complementing any government cost of living help UK that might be available.

Conclusion

So, the bottom line about a new £600 Cost of Living Payment in 2025? While the buzz was understandable, official government sources confirm that no such broad, one-off payment is actually planned. The temporary Cost of Living Payment scheme wrapped up in early 2024, signalling a clear shift in the government’s approach to UK cost of living support. Instead, for 2025 and 2026, the focus is firmly on strengthening our existing welfare provisions, providing localised assistance, and delivering regular benefit increases.

If you’re a household grappling with financial challenges, your attention should really turn to the extended Household Support Fund, which offers essential localised aid through your local councils, and the DWP benefit increases scheduled for April 2025 and 2026. Plus, those positive changes to Universal Credit deduction caps will definitely offer greater financial stability for claimants. By actively seeking out official information from GOV.UK and your local council websites, and combining this with solid budgeting, energy efficiency, and debt advice strategies, you can effectively navigate the current economic landscape and access the genuine government cost of living help the UK has available.